The AI Chip Demand is surging, and Micron Technology is positioned to capitalize on this growth. Bolstered by significant demand for high-bandwidth memory (HBM) chips essential for artificial intelligence applications, the U.S. memory chip maker has substantially raised its financial forecasts, signaling a robust outlook in the face of increasing AI hardware requirements.

Table of Contents

Micron’s Forecast Skyrockets Amid AI Boom

Micron Technology’s revised fiscal fourth-quarter revenue prediction, now ranging from $10.4 billion to $11 billion, emphatically surpasses Wall Street’s expectations. This upward revision, reported by sources including Mitrade, Nasdaq, AInvest, Barchart.com, and Bloomberg, underscores the tangible impact of the AI-driven demand on the semiconductor industry. The company’s shares have responded positively, outperforming many of its peers within the sector, indicating strong investor confidence in Micron’s strategic direction and its ability to meet the escalating demands of the AI market.

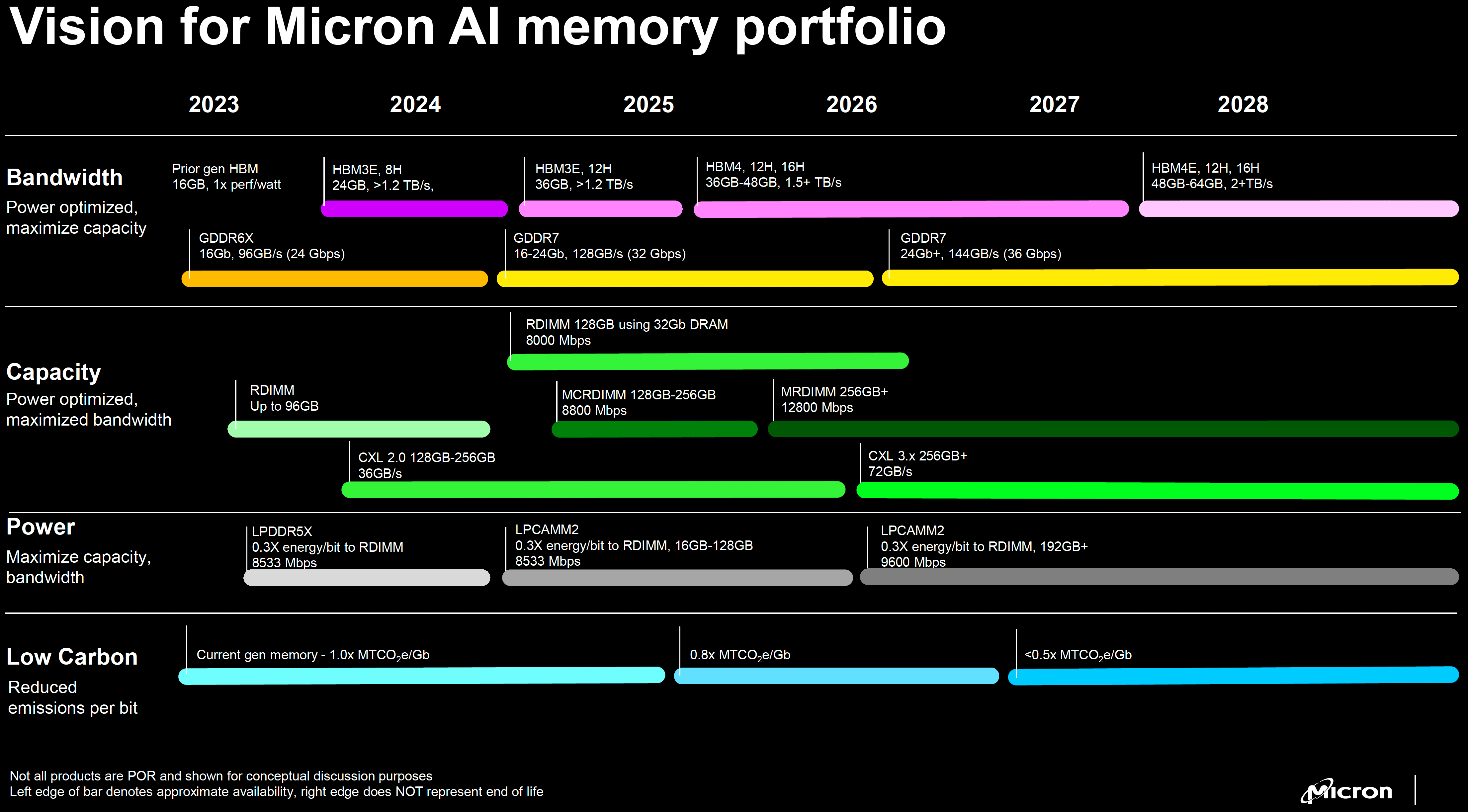

High-Bandwidth Memory (HBM) Fuels Growth

The surge in demand is largely attributed to the increasing need for high-bandwidth memory (HBM) chips. These specialized chips are crucial for powering AI applications, particularly those utilizing advanced AI processors like those from Nvidia. HBM’s ability to handle vast amounts of data at high speeds makes it indispensable for AI workloads, directly benefiting Micron, a key player in HBM production. The company’s success highlights the critical role of memory technology in enabling the continued advancement of AI capabilities across various industries.

Strategic Investments to Meet Demand

To capitalize on the burgeoning demand, Micron is making significant investments in its production capabilities. The company has allocated $3.5 billion in capital expenditures to boost the output of both DRAM and NAND memory chips. These chips are essential components of AI infrastructure, and Micron’s investment ensures that it can meet the growing needs of its customers. This proactive approach underscores Micron’s commitment to remaining a leading provider of memory solutions for the AI market.

Navigating the Broader Economic Landscape

While Micron is clearly benefiting from the AI boom, the company remains cautiously optimistic about the broader macroeconomic environment. The global economy continues to face uncertainties, and Micron acknowledges the potential impact of these factors on its overall performance. Despite these concerns, the company’s strong financial outlook and strategic investments demonstrate its resilience and its ability to navigate the challenges of the current economic climate.

Attribution and Expert Insights

Micron’s raised financial forecasts, initially reported by Bloomberg and subsequently covered by Nasdaq and other outlets, reflect the company’s strong position in the AI-driven semiconductor market. The company’s performance is a direct result of the increased demand for HBM chips, which are essential for AI applications. According to industry analysts at Barchart.com, Micron’s strategic investments in production capacity will further solidify its position as a leading provider of memory solutions for the AI market. The fiscal fourth-quarter revenue prediction of $10.4 billion to $11 billion, as stated by Micron, significantly exceeds Wall Street’s expectations, underscoring the company’s strong financial outlook. Reports from AInvest highlight the outperformance of Micron’s shares compared to its peers, showcasing investor confidence in the company’s strategic direction. Mitrade’s coverage emphasizes the importance of HBM chips in powering AI applications, further highlighting Micron’s crucial role in enabling the continued advancement of AI capabilities.

The Future of AI and Memory Technology

The convergence of AI and memory technology is reshaping the semiconductor industry. As AI applications become more sophisticated and data-intensive, the demand for high-performance memory solutions will continue to grow. Micron’s strategic investments and technological advancements position it to capitalize on this trend and remain a key player in the AI ecosystem. The company’s success demonstrates the importance of innovation and adaptability in the rapidly evolving technology landscape.

In conclusion, Micron Technology’s enhanced financial forecasts, fueled by the escalating demand for AI hardware, highlight the profound impact of artificial intelligence on the semiconductor industry. With strategic investments in production capabilities and a focus on high-bandwidth memory solutions, Micron is well-positioned to continue its growth trajectory and play a pivotal role in enabling the future of AI. While mindful of broader economic risks, the company’s proactive approach and strong performance underscore its resilience and commitment to innovation in the dynamic world of technology.